September 8, 2017

More Tax Cuts for the Rich: A Familiar, Failed Recipe

With the U.S. Congress back from their August recess, the Trump administration and congressional leadership plan to move forward with their effort to overhaul the federal tax code. President Trump has spoken in Missouri and North Dakota to promote his tax reform plan, and there are indications he will have more events this fall as part of the same push. Meanwhile, powerful interest groups are airing TV ads about the supposed benefits of tax reform. Before the noise machine gets even noisier, let’s pause a moment and consider what we know so far about these proposals and their real-world impacts on families.

The Institute on Taxation and Economic Policy (ITEP) recently released an analysis of federal tax reform’s likely impacts on Virginia based on the broad plans outlined so far by the administration and congressional leaders. That includes many provisions intended to benefit the wealthy, such as cuts to or the complete elimination of the tax on net investment income, the federal alternative minimum tax, and the estate tax.

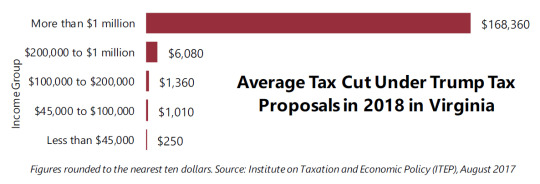

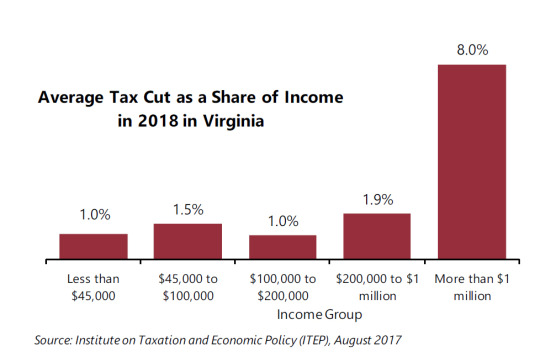

This is true if we look at the potential impact right here in Virginia. Of total tax cuts going to Virginia residents, ITEP estimates that 48 percent of these cuts would go to millionaires while only around 5 percent would go to those earning less than $45,000 a year. In dollar terms, Virginia’s millionaires would receive a tax cut of nearly $170,000 on average (8 percent of their income). In contrast, Virginians earning less than $45,000 annually would receive $250 on average (1 percent of their income). While those pushing for tax reform have been paying lip service to helping the middle class, this analysis shows that the tax reform package chiefly represents a massive tax cut for the wealthiest.

And it’s wrong to consider the impact of tax cuts without also considering how they will be paid for, either by today’s workers or future generations. So far, the tax plans from the administration and congressional leaders have not included realistic measures to offset the proposed tax cuts for the wealthy. But sooner or later, those cuts will have to be offset, whether through cutting critical public services or raising other taxes to the tune of $3.5 trillion or more over a decade. And if they’re offset by the type of cuts proposed in the administration’s budget, 94 percent of American households would be net losers, while those at the highest income and wealth levels see huge gains.

While there are real reform ideas that could create a fairer tax system and help families of all income levels, we should call this latest tax reform push what it is: a large tax cut for the wealthiest. And when it comes to tax cuts for the rich, the promised economic growth often fails to materialize. This time around, we should ask lawmakers to choose a different path.

Category:

Budget & Revenue