November 9, 2017

New Data Confirms that in Virginia the Federal Tax Plan is a Jackpot for the Rich Paid for by the Other 99%

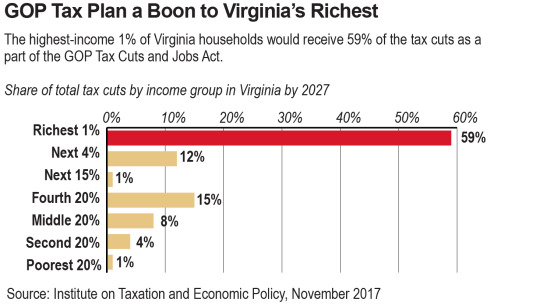

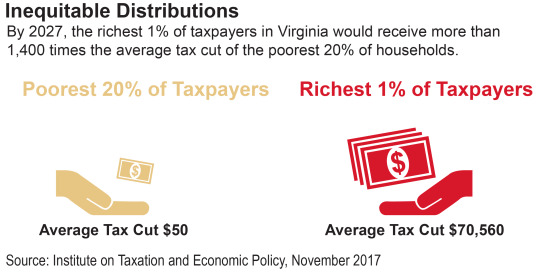

The Tax Cuts and Jobs Act, introduced on November 2, would blow a $1.5 trillion hole in federal deficits over the next decade. It primarily benefits Virginia’s top earners while jeopardizing essential services for low- and middle-income families. Parts of the plan would go into effect in 2018, but it’s a multi year proposal and some impacts would increase over time. New analysis released earlier this week by the Institute on Taxation and Economic Policy reveals that by 2027, 59 percent of all of the tax cuts from this act would go to the top 1 percent of taxpayers in Virginia. That’s an average tax cut of $70,560 annually for this group. Meanwhile, by 2027, middle-income families could expect to see an average tax cut of $450 annually and low-income families making an average income of $20,500 could expect to see a cut of just $50.

On the surface, any cut may be welcome for low- and middle-income families. But the massive cuts afforded to the richest families in the state would lead to a growing federal deficit that would eventually need to be paid for by everyone. If the budget passed earlier this year by Congress is any indication of what is to come, we can expect to see services across the board cut – this includes funding for education, health care and other social services targeted toward low- and middle-income working families.

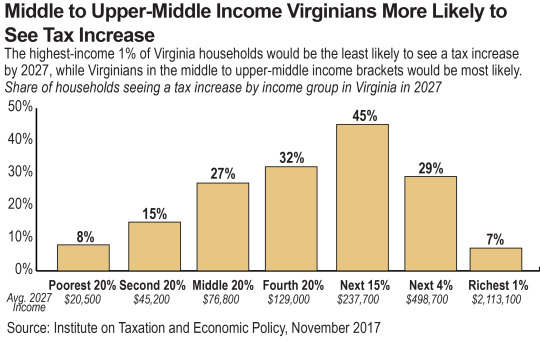

Even with cuts to major governmental services, not all Virginia taxpayers would see a tax cut. More than a quarter of middle-income families and nearly half of upper-middle income families in Virginia (those with average incomes between $170,450 and $362,220) would pay more in federal taxes under the new House proposal in 2027. It might be called the Tax Cut and Jobs Act, but neither aspects of this title are necessarily true or likely for many Virginia families.

Category:

Budget & Revenue