June 17, 2019

New Federal Tax Credit Proposals Would Help Families In Virginia

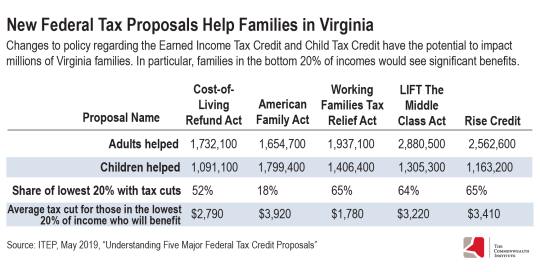

Decisions about tax policy reflect our values as a society and have a direct impact on our ability to support our families and contribute to our communities. No family should lack the basic resources necessary to thrive, and some federal policies are in place to specifically boost incomes for low and moderate-income families. Unfortunately, recent federal legislation such as the Tax Cuts and Jobs Act (TCJA) runs counter to these goals by concentrating its benefits among the highest-income individuals and large corporations. Strengthening programs that support families is a vital step towards a more equitable society. Five tax proposals at the federal level aim to take this step, and any one of them could help more than 1 million children in Virginia alone.

A new report by the Institute on Taxation and Economic Policy (ITEP) examines the impact of these five major tax proposals: The Cost of Living Refund Act, The American Family Act, The Working Families Tax Relief Act, The LIFT the Middle Class Act, and the Rise Credit. While they focus on different aspects of federal tax policy, each of these would boost incomes for those with low to moderate incomes, and could be particularly helpful for families with children. All of these proposals would create a more progressive tax system, meaning that individuals with higher incomes and a higher ability to pay would have a higher tax rate than individuals with lower incomes. The plans would achieve this by lowering taxes for households in the bottom 60% of incomes (those families with incomes less than $75,600 in Virginia), with particular focus on the lowest 20%. This could be especially helpful given that families with the lowest income pay a greater share of that income toward state and local taxes than those with higher incomes.

All of these proposals have the potential to promote a more equitable Virginia. The legacy of systematic discrimination and exclusion has closed off economic opportunity for many of Virginia’s Black and Latinx families. Black and Latinx workers are more likely to be paid low wages and struggle to make ends meet, and between 2007 and 2017, saw their real median wages decline. Recent data show that 77% of Black households and 73% of Latinx households in Virginia were in the bottom 60% of income, compared with 54% of white households. And tax policies such as the Tax Cuts and Jobs Act, which overwhelmingly benefitted white households, reinforce and worsen existing inequities. By focusing benefits on lower income households, these five recent tax proposals would represent meaningful steps towards addressing these issues.

The Cost of Living Refund Act

The Cost of Living Refund Act, which is cosponsored by Rep. Bobby Scott of Virginia’s Third Congressional District, would boost incomes by expanding the current federal Earned Income Tax Credit (EITC). The current value of the EITC increases as a family’s income increases up to a certain point, before plateauing and then gradually phasing out. The Cost of Living Refund Act would expand the EITC by substantially increasing the value of the credit and newly allowing younger tax filers to receive the credit. Under the proposal, more families would benefit from the EITC. Working people in Virginia who are in the lowest 20% of incomes would see the largest reduction in taxes as a share of income. And Virginians in the second lowest income group would have the largest share of families with tax cuts.

The American Family Act

The American Family Act is primarily focused on reforming the existing Child Tax Credit (CTC). Due to current restrictions, the current CTC is not as effective as it could be at supporting families with low incomes. Because the CTC is not fully refundable, many families do not receive the full value of the CTC. Increasing the CTC amount and allowing all families to get the full value of their credit would result in a substantial income boost for low- and middle-income families. This particular proposal could help nearly 1.8 million children in Virginia

The Working Families Tax Relief Act

The Working Families Tax Relief Act combines the two approaches above by making improvements to both the EITC and CTC. The proposal allows for individuals with higher income levels to be eligible for the EITC compared to the current credit. The proposal also makes the CTC fully refundable, and it increases the credit amount for children under the age of six. Expanded eligibility for the EITC and a fully refundable CTC would boost incomes for low-income Virginians. Roughly two-thirds of Virginia households with incomes less than $24,500 would see, on average, an income boost of almost $1,800.

In April, Sens. Warner and Kaine announced that they had signed on as co-sponsors of this legislation.A House version of the proposal was introduced by Rep. Dan Kildee of Michigan and Rep. Dwight Evans of Pennsylvania in early June.

New Tax Credits

The LIFT the Middle Class Act and the Rise Credit proposals would create new tax credits. The LIFT the Middle Class Act would supplement the EITC, creating new credits that would phase out at higher incomes than the EITC, while allowing students to count Pell grants as earnings to qualify for the credit.

Meanwhile, the Rise Credit would replace the EITC. The current EITC is primarily directed at working families with dependent children, while the full value of the Rise Credit would be available to more families – including adults with certain types of caregiving responsibilities and certain types of students – and is not adjusted for number of children in the base credit value. The Rise Credit proposal uses separate supplemental credits to adjust for family size. The Rise Credit would most directly benefit the lowest-income group of Virginia families with 83% in this group expected to have a tax benefit, while also benefiting middle-income families.

These five proposals would have a positive impact on low- and middle-income families in Virginia. Tax policy can be used as a tool to improve the lives of everyone, and any of these would be a move in the right direction after recent policies such as the Tax Cuts and Jobs Act gave benefits largely to higher-income households. Further, they would promote a more equitable society by boosting incomes for groups that continue to face systematic discrimination and exclusion, such as Black and Latinx Virginians. Expanding EITC eligibility and a fully refundable CTC can help to make sure that everyone in Virginia is able to support their family and contribute to thriving communities. Every member of Virginia’s congressional delegation should consider supporting legislation to strengthen and improve refundable tax credits for families.

Category:

Budget & Revenue