July 30, 2018

Sales and Excise Taxes under the Microscope: Impacts by Race

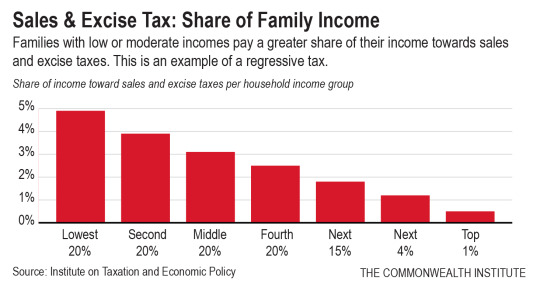

Virginia’s tax system plays a key role in shaping economic opportunity by paying for the building blocks of thriving communities like schools, roads, and libraries. Sales taxes on consumer goods and excise taxes on specific items like gasoline or tobacco products are a significant component of our state and local tax systems, and we know that in Virginia, lower-income households pay a higher share of their incomes toward these taxes than higher-income households. That’s because lower-income households spend more of their income on purchasing items that are taxed such as food and gas, while higher-income households spend more money on untaxed services and savings. And because of stark differences in income by race, this means these sales and excise taxes particularly hit families of color who are more likely to be paid low wages and struggling to make ends meet. In this respect, a key component of Virginia’s state and local tax system is reinforcing existing barriers to economic opportunity.

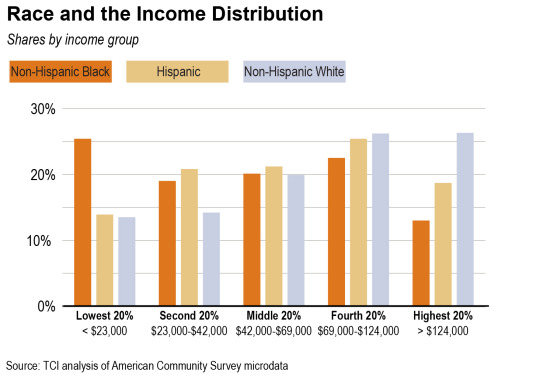

Black households in Virginia are relatively more likely than non-Hispanic white households to be in the lowest two income groups that pay the highest share of their income in sales and excise taxes, and Hispanic households are relatively more likely to be in the second-lowest income group according to our analysis. The reverse is also true. Black and Hispanic households are less likely to be in the highest income groups. Meanwhile non-Hispanic white households are less likely to be among the lowest two income groups and relatively more likely to be in the highest two income groups, where households pay a lower share of their income in sales and excise taxes.

State and local governments provide a range of important public services, like K-12 education, transportation, and health care. These are important investments that help to create the foundations for long-term economic prosperity and help families thrive. However, when the taxes to pay for these investments fall harder on families being paid lower wages – often people of color – these investments aren’t doing all they can to boost opportunity across all of our communities.

Fortunately, state policymakers have tools available to offset this impact. Working families tax credits are one option to address some of the shortcomings of sales and excise taxes and support low-wage working people. These targeted credits often take the form of an earned income tax credit. And due to long-standing income and wealth disparities by race, this kind of working families tax credit lifts a large share of the non-white and Hispanic populations out of poverty. Strengthening Virginia’s existing working families credit would likely expand opportunity even further for many families of color.

The legacy of structural racism remains with us today, from school segregation to maternal health disparities. Likewise, the upside-down nature of Virginia’s state and local sales and excise taxes has an outsized effect on low-income families, who are often families of color. When we turn to these revenues without offsetting the impacts on low-wage workers, it means a disproportionate amount of the cost of new investments, no matter how worthy, is being paid by people of color.

Category:

Budget & Revenue