February 21, 2020

State Funding Proposals Include Regressive Tax Increases – Many without Offsets

Last week, the 2020 General Assembly session reached the point of the legislative calendar known as “crossover.” From crossover until the end of session, the House of Delegates only considers legislation that has passed the Senate, and the Senate only considers legislation that has passed the House (the lone exception is the budget bill). Although many significant state tax policy bills filed for this year did not move beyond the committee level, several proposals remain under consideration. A large transportation funding package (HB 1414 and SB 890) and several standalone regional transportation funding bills have advanced from their respective chambers in the Virginia General Assembly. In addition, proposed increases to cigarette and tobacco taxes are included as part of the House and Senate budget proposals.

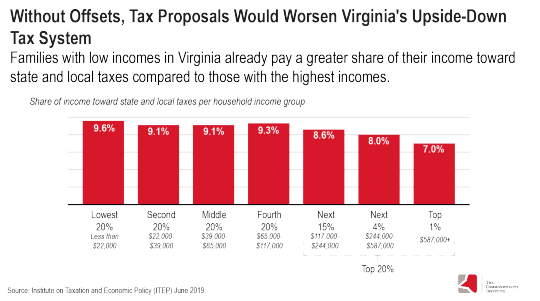

These transportation bills would generate needed new revenues for transportation projects across the state, including public transit. However, in their current form, several of these and other proposals, such as increased cigarette taxes, would worsen Virginia’s already upside-down, or regressive, tax system (where families with the lowest incomes pay the highest share of their income toward state and local taxes on average, while those with the highest incomes pay the lowest share). Lawmakers should make sure that proposed offset measures, such as fee reductions, are included in the final version of the legislation.

Category:

Budget & Revenue