April 3, 2023

Status Report: What’s Happening With Virginia’s Budget

First published: March 15, 2023

Last updated: April 3, 2023 to reflect current status of the budget process, including the governor’s proposed amendments to the stop-gap “skinny” budget amendments.

Virginia’s regular legislative session ended on February 25 without an agreement between the House and Senate on major tax and spending matters that are decided through the state budget. Legislators have stated that they are continuing to work on the budget and will return when they have a deal.

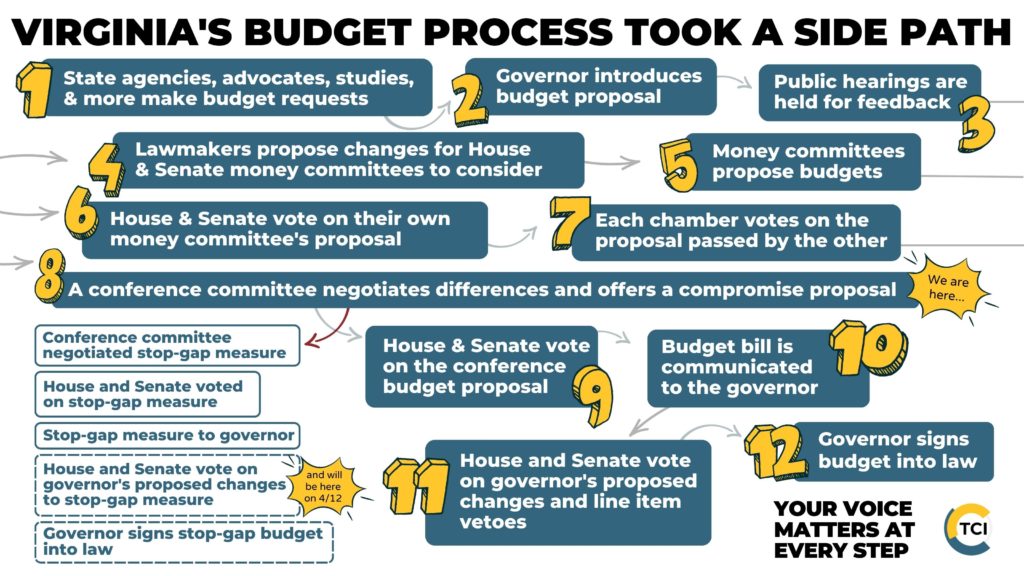

Below is a brief summary of Virginia’s budget process, the “skinny” stop-gap budget changes, and what’s next.

Virginia’s normal budget process

Virginia has a two-year budget process.

Each December, the governor proposes a budget for the upcoming two fiscal years or amendments to the current two-year budget. This year, that meant that in December 2022, Governor Youngkin proposed a set of changes to the current two-year budget that covers this fiscal year (which started July 1, 2022) and the upcoming fiscal year (which starts July 1, 2023).

Next, during the legislative session, the House and Senate each propose amendments to the governor’s proposal. After each legislative chamber rejects the other’s proposal, the House and Senate appoint “conferees” who negotiate a deal and present a “conference report” that the House and Senate then approve.

Then, the governor has the opportunity to propose amendments and line-item vetoes to the budget, which the legislature then votes up or down. If everything runs on time, that happens during the “reconvened” session on the sixth (or seventh) Wednesday after the end of the regular session.

What’s different this year

This year, the House and Senate conferees couldn’t reach agreement on the big differences between their proposals. The Senate budget included major new investments for public schools, while the House budget uses that money and more for large tax cuts, mostly for profitable corporations and wealthy individuals.

But as an initial step forward, the conferees did propose a “skinny,” or stop-gap, budget agreement to make required deposits to the state’s Revenue Stabilization (“rainy day”) Fund, provide some surplus revenue from the prior fiscal year to capital projects and the Virginia Retirement System as they had agreed to do in last year’s budget agreement, make technical updates to K-12 funding, and provide $16.8 million toward fixing the $201 million math error by the State Department of Education. This stop-gap budget passed the House and Senate and the governor has proposed some additional amendments, which will be considered by the House and Senate during the reconvened session on April 12. The governor’s amendments update revenue estimates, provide funding to make sure Virginia can meet its obligations to TANF recipients, provides federal COVID relief funds to help fund the required Medicaid redetermination of eligibility process, and to authorize a loan for a high-performance data center at Jefferson Lab.

What’s next

In addition to addressing the governor’s amendments to the stop-gap budget, legislators have stated they are still working on the main budget.

With the “stop-gap” budget appropriating just over $1 billion of the approximately $4.5 billion in available resources, major opportunities remain for legislators to invest in great schools for every Virginia student, health care for children, and other priorities that help to build a strong economy and support thriving communities. Yet threats also remain, including a proposed $1 billion in tax cuts in the House budget. It is important to understand that legislators do not have to pass more budget amendments this year – they already passed a two-year budget that includes the upcoming fiscal year. Not passing amendments would mean the state goes into next year with very large surpluses, which would likely be appropriated during the 2024 session for one-time items. If legislators do pass additional amendments, it’s important that they focus on what matters most for families and communities: targeted help for families struggling with increasing costs, fixing schools, expanding health care access, and making sure profitable corporations and wealthy individuals pay their fair share.

Category:

Budget & Revenue