October 17, 2018

Virginia’s Tax System Is Upside Down

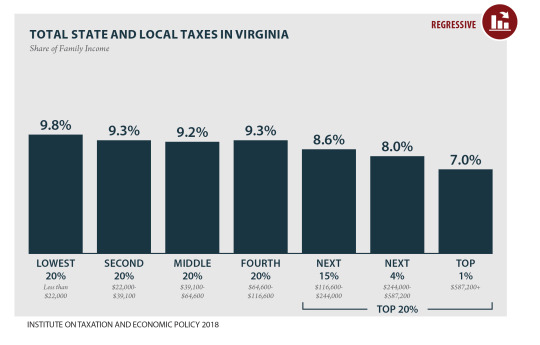

Virginia’s state and local taxes help to shape economic opportunity across the state. That’s because state and local revenues pay for the building blocks of thriving communities: schools, roads, libraries, and other public services. Unfortunately, the current state and local tax system is upside down. Families in Virginia have taxes withheld from their paychecks, and they also pay taxes when they shop at local businesses, buy groceries, or fill their gas tanks. But updated analysis from the Institute on Taxation and Economic Policy (ITEP) shows that Virginia’s low- and moderate-income households pay a higher share of their incomes toward state and local taxes than the highest-income households.

Low- and moderate-income households in Virginia who may pay relatively lower amounts toward state income taxes still must pay other state and local taxes: sales taxes, gas taxes, property taxes, and other state and local taxes and fees. While low- and moderate-income households spend more of their income on purchases subject to tax like food and gas, higher-income households spend more on untaxed services and savings. As a result of this dynamic, Virginia’s state and local tax system reinforces existing barriers to economic opportunity.

The ITEP analysis shows that Virginia households making under $22,000 a year pay, on average, 9.8 percent of their income in state and local taxes. Meanwhile households in the state who have incomes between $244,000 and $587,200 per year pay only 8.0 percent on average. And for Virginia households with incomes above $587,200 per year, the share of their income paid toward those taxes is even lower at 7.0 percent.

State and local governments make important investments to help build the foundations for long-term prosperity. Families and communities thrive when they have high-quality K-12 schools,

effective

transportation, and health care. However, when the taxes to pay for these investments fall harder on working families, many of whom are struggling to make ends meet, these investments aren’t doing all they can to boost opportunity.

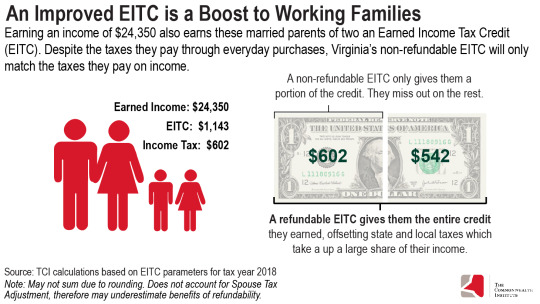

Fortunately, state policymakers have a tool available to offset this impact. The Earned Income Tax Credit (EITC) is one of the most effective policies to support working families and help create a fairer, more balanced tax system. The value of a family’s EITC is determined by their level of income, filing status, and family size. And its design means the credit is well-targeted – a credit that boosts working families.

In addition, strengthening Virginia’s EITC by making it refundable would help families lift themselves out of poverty. A fully refundable state EITC would lift about 16,000 people in Virginia, including nearly 8,000 children, above the poverty line (about $20,800 a year for a family of three). And many families who receive federal and state EITCs no longer claim the credits within two years because their earnings increase beyond the eligibility cutoff. The benefits of the EITC are wide ranging, extending from maternal health to children’s educational attainment.

Working families across the state are paying a higher share of their incomes to state and local taxes than the highest-income households. A stronger state EITC would go a long way toward counteracting this imbalance.

Category:

Budget & Revenue