November 13, 2017

A Tax System for Yesterday: Slow Revenue Growth amid Economic Change

Virginia’s current revenue system isn’t keeping up with changes and growth in the overall economy, and that’s putting the future prosperity of families and businesses at risk.

A series of recent developments point to Virginia’s challenges. The Secretary of Finance recently informed state lawmakers that e-commerce is costing the state an estimated $229 million in lost sales tax revenue. A major credit rating agency issued a “negative outlook” for Virginia as a result of lawmakers consistently tapping the state’s rainy day fund, even during periods of economic growth, when faced with revenue challenges. And even though the state currently enjoys a strong overall economy with an unemployment rate of 3.7 percent, over 40,000 jobs added since last September, and signs that median household income is headed in a positive direction, revenue collections have fallen behind historical trends relative to the overall state economy.

Virginia has three major sources of state tax revenue: individual income taxes, corporate income taxes, and state sales taxes. But the way the current revenue system works was designed decades ago, with provisions that no longer work for today’s economy and are not keeping pace with current needs.

Enacting needed reforms to each revenue source would begin to reverse the erosion of Virginia’s revenue relative to the overall economy and provide for boosted investments in important priorities.

This issue brief identifies troubling trends in each of the state’s major areas of revenue, lays out possible root causes, and offers remedies for lawmakers to address these challenges.

Background: A Departure from Past Trends

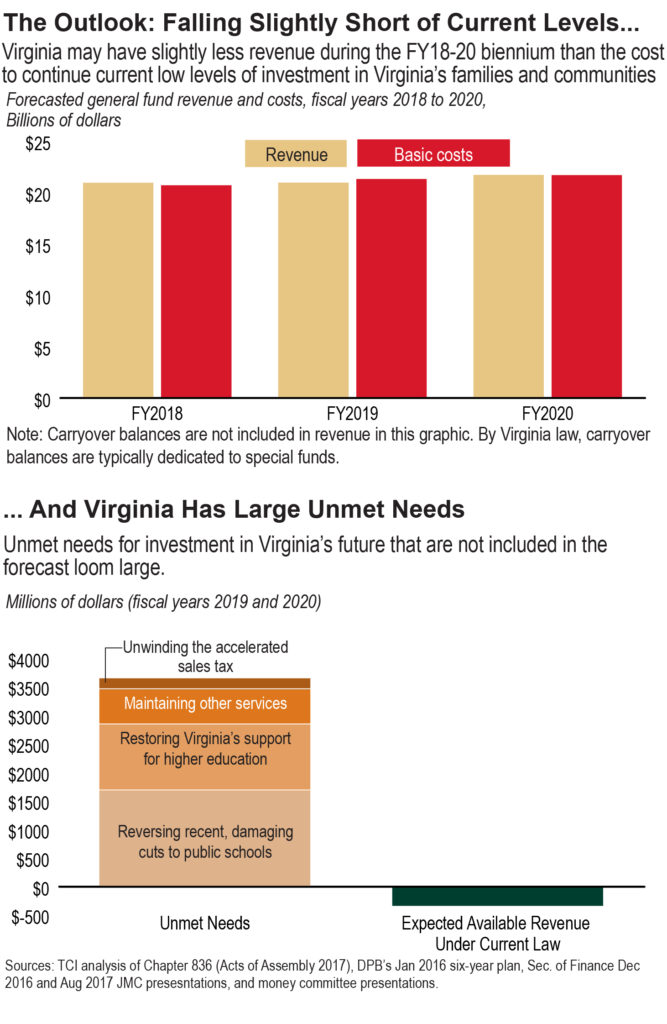

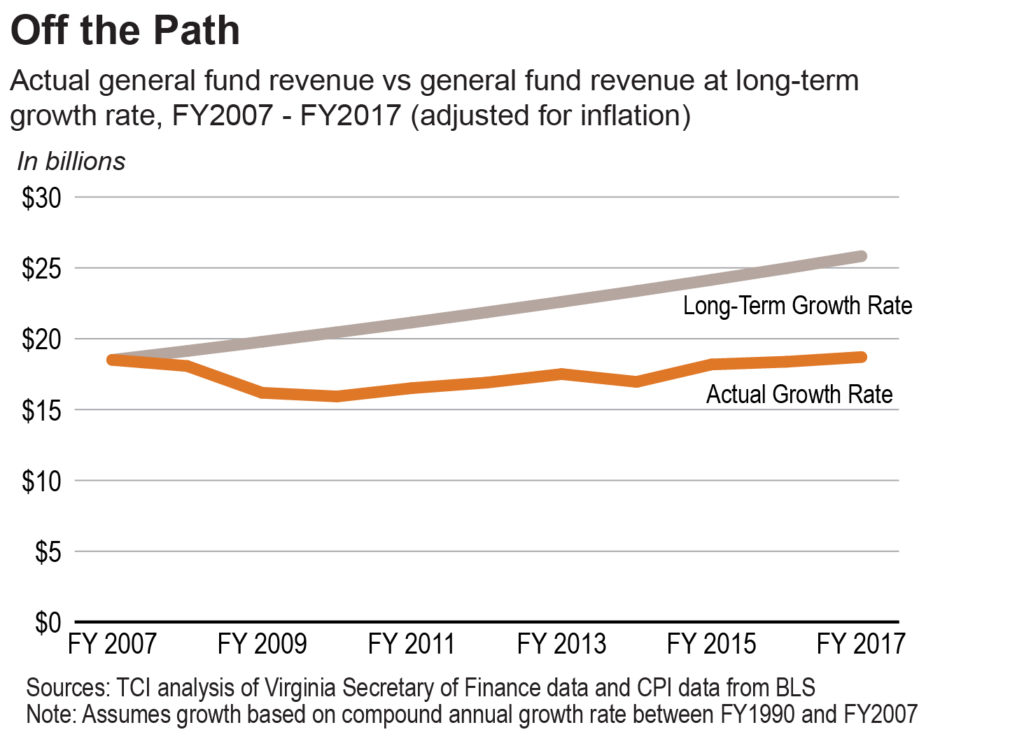

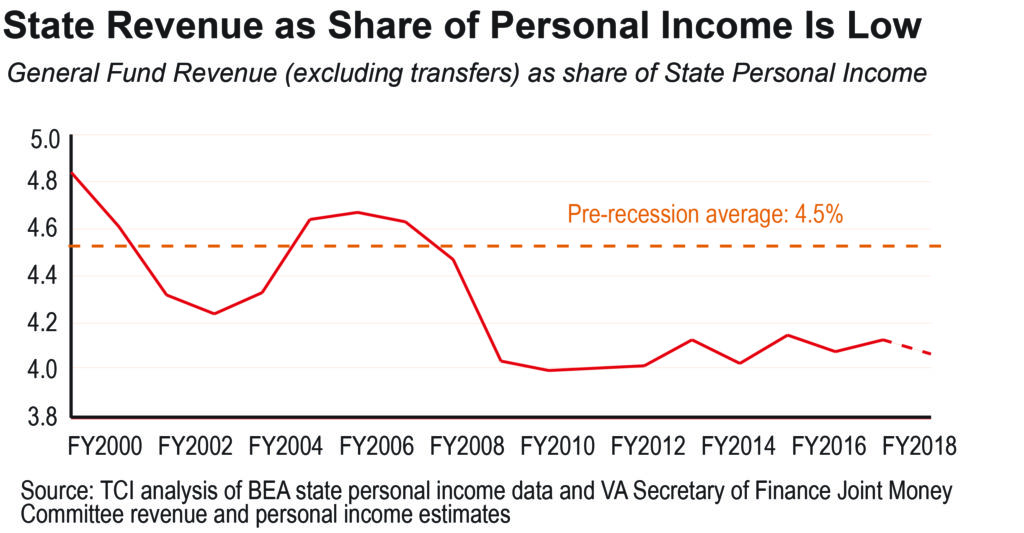

Recently, however, the relationship between revenues and the broader economy has changed relative to the historical trend. Since FY 2009, Virginia’s general fund revenues as a share of personal income have hovered around 4.1 percent, compared to a pre-recession average of around 4.5 percent. This difference is equivalent to approximately $1.8 billion in FY 2017 – money that could be used to invest in K-12 education, health care, and other state priorities.

In addition to that trend, actual state revenue collections were much lower than official projections in FY 2014 and FY 2016. (Fiscal years run from July through June.) Although it is not unusual for actual revenues to vary from forecasts, these years of lower-than-expected revenue growth occurred even while the broader economy showed growth. It is unclear if these shortfalls were blips or whether they are evidence of deeper changes in areas like work arrangements, how corporations report profits, or consumer preferences.

In response to shortfalls, policymakers have consistently tapped into the state’s rainy day fund, a move viewed unfavorably by at least one major credit rating agency, which lowered Virginia’s economic outlook from “stable” to “negative” as a result.

After identifying the underlying causes of slow revenue growth, policymakers can pursue specific reforms to restore more of the tax base and put the state on a more sustainable path.

Underlying Problems: Analysis by Major Revenue Source

Corporate Income Tax

Virginia currently taxes corporate profits at a 6 percent flat rate, which is tied for the eighth lowest rate of the 32 states with a flat corporate income tax. Many corporations in Virginia have zero state corporate tax liability, possibly because the tax only applies to net profits. Corporations also are able to claim various tax credits and deductions to further reduce or even eliminate their taxable income. In addition, key research indicates large multi-state corporations seem to be using aggressive methods of tax planning, which means greater opportunities to shift profits outside of Virginia to minimize the amount of taxes owed.

As a result, the share of state income tax revenue from the corporate income tax has seen a steady decline over time. Virginia’s corporate income tax provided 15 percent of Virginia’s income tax revenue in 1980 compared to just 6 percent in 2016. In the time period since FY 2003, state corporate income tax collections peaked at $1.1 billion in inflation-adjusted dollars in FY 2006. Inflation-adjusted collections totaled $779 million in FY 2016, a drop of 26.7 percent from the pre-recession peak. Collections rebounded in FY 2017 to $827 million. These trends have emerged despite growing corporate profits. Nationally, before-tax corporate profits have grown 51.2 percent since FY 2009.

There are several possible causes for the erosion of corporate income tax revenues. Increased tax avoidance and the creation or expansion of various tax credits and deductions may minimize the amount of profits subject to state tax.

Also, unlike 25 other states and the District of Columbia, Virginia does not require combined reporting, which requires large corporations to report profits from all their subsidiaries in all locations. Shifting profits to subsidiaries in states with lower tax rates or no corporate tax at all is one way large corporations can avoid taxation.

Another issue is the concept of “nowhere income,” which results when some portion of a corporation’s sales are not attributed to any state – for instance, when a corporation does not meet certain sales thresholds in a state – and so goes untaxed. Corporations may structure their operations in such a way to maximize nowhere income and lower the amount of their profits subject to state corporate taxation. Some states have adopted “throwback” or “throwout” provisions as a result, which would help to account for this practice, by requiring companies to attribute any untaxed sales to the state of origin for tax purposes (or “throwing out” and excluding any untaxed sales).

Besides tax avoidance, Virginia also has a number of business tax expenditures that reduce the amount of taxes owed by businesses. For example, Virginia’s single sales factor apportionment allows large manufacturers to be taxed based on sales alone rather than on the traditional apportionment formula that uses in-state payroll, sales, and property. These kinds of tax provisions do not appear to have a meaningful impact on manufacturing employment, which has declined across the country regardless of apportionment formula over the past decade, and Virginia’s provision is estimated to cost the state close to $60 million annually in forgone revenues.

In addition to state tax credits and deductions, many federal tax provisions flow through to the state level, because Virginia generally conforms to the federal tax code. In FY 2010, Virginia lost an estimated $227 million in revenue due to federal tax loopholes enacted since 1985, a portion of which is attributable to corporate tax provisions. In recent years, federal tax legislation has included provisions related to certains kinds of business expensing, which has been permanently extended and indexed to inflation, and an expanded domestic production activities deduction, which Virginia fully conformed to as of 2013. Virginia does “decouple” from some federal provisions, such as “bonus depreciation,” which saves the state hundreds of millions of dollars in revenue. Decoupling from additional provisions would help to restore some of Virginia’s corporate income tax base.

As corporate operations and accounting practices change, Virginia must update its corporate tax system to minimize opportunities for tax avoidance. For example, re-enacting the state’s throwback rule (repealed by the General Assembly in 1981) would help to counter “nowhere income.”

State Sales Tax

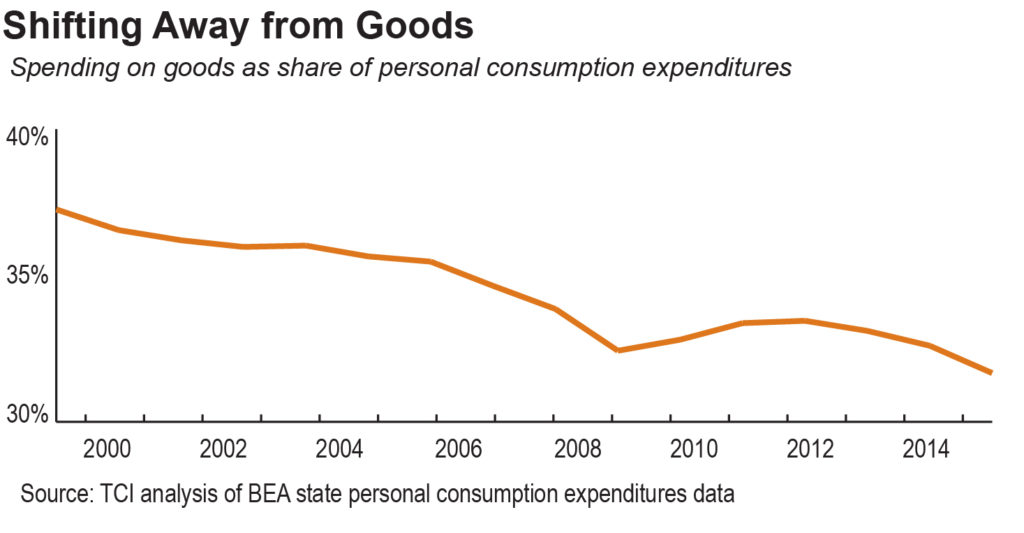

Shifts in consumer spending and growth in e-commerce have likely contributed to state sales tax revenues decreasing relative to broader economic indicators. Virginia currently has a combined state and local sales tax of 5.3 percent (6 percent in certain Northern Virginia and Hampton Roads localities). State sales tax revenues represented, on average, 0.92 percent of state personal income from FY 2003 through FY 2008, while the share from FY 2009 through FY 2017 was 0.79 percent. This does not appear to be driven by a reduction in spending because data on personal consumption expenditures (PCE) show an increase of 22.8 percent between 2009 and 2015, roughly in line with the growth in state personal income of 24.5 percent during the same timeframe. As a share of PCE, sales tax revenues were 1.0 percent in 2015, a decline from 1.3 percent in 2000.

These developments seem driven by broader economic changes. Consumer spending continues to shift from goods toward services, which often are not taxed. The Federation of Tax Administrators conducted a survey that showed only 18 of 168 types of services were subject to the state sales tax in Virginia in 2004, and Virginia has not substantially expanded its sales tax base since that time. Spending on goods represented 31.7 percent of personal consumption expenditures in 2015, a decline from 37.3 percent in 2000 (services make up the remainder).

In addition, e-commerce continues to grow. Nationally, e-commerce represented an estimated 8.5 percent of all retail sales in the first quarter of FY 2017. This is more than double the share in the same period in FY 2010 and more than quadruple the share in the same period in 2004. States are often unable to collect sales and use taxes for online purchases.

While brick-and-mortar retailers and online merchants with “nexus,” or physical presence, collect sales tax directly from customers, other online sellers do not have this same responsibility. Customers are tasked with self-reporting and sending payment to the state, and this often does not occur and is not enforced. Due to a U.S. Supreme Court ruling on this issue, states are limited in their ability to require sellers to collect this tax. Virginia has enacted smaller measures, such as HB2058 in the 2017 session, which clarified the definition of “nexus” to include storage of inventory and will raise an estimated $21 million in state and local revenues.

To keep pace with these broader trends, Virginia needs to modernize its tax code by adding more services to the sales tax base and passing legislation to improve sales tax collections connected to online and digital purchases. Virginia could encourage greater self-reporting of use taxes owed by allowing most tax filers to use a simplified calculation based on income instead of having to account for every online purchase for which tax was not applied. According to the Secretary of Finance, Virginia fails to collects about $229 million in sales tax due to the effect of e-commerce.

Individual Income Tax

State individual income tax revenues account for 70 percent of overall general fund revenues. Research shows that income tax revenues tend to fall sharply during recessions but then increase relatively quickly during periods of economic growth. For FY 2017, net individual income tax collections finished ahead of forecasts. However, collections in non-withholding income taxes were lower than expected for the year, and many experts attribute this to high-income households delaying realization of capital gains income in anticipation of federal tax cuts. In recent years, overall individual income tax revenues as a share of state personal income appear to have recovered since the recession and have returned close to the historical average.

Over the longer term, because of an evolving economy and possible changes to the federal tax code, policymakers will need to monitor developments in state individual income tax collections.

Of particular concern is the way changes to federal tax laws could impact state revenue. In FY 2010 Virginia lost an estimated $227 million in revenue due to federal tax loopholes enacted since 1985, a portion of which is attributable to individual income tax provisions. That’s because, with few exceptions, Virginia conforms to the federal tax code, meaning Virginia income taxes are calculated using federal adjusted gross income as the starting point. Federal provisions that impact state tax revenue include deductions from gross income such as contributions to retirement plans and health savings accounts, as well as provisions used by businesses whose owners file taxes at the individual level, not the corporate level. State lawmakers should monitor the ongoing impacts of conformity to the federal tax code and the associated revenue losses and consider full or partial decoupling from additional provisions.

Another development that could complicate income tax revenue trends in the near future is the rise of independent contractors and employees misclassified as contractors. The news is full of stories about increased opportunities in contract work, such as gig economy jobs, and how it’s driving larger economic changes. Although we lack reliable or comprehensive state-level data on this trend, researchers at the Brookings Institution used federal data on “nonemployer firms” – firms that earn at least $1,000 per year in gross revenues but employ no workers – to try to capture these developments and showed growth in sectors like transportation and traveler accommodations.

For contract workers, certain aspects of tax compliance, such as sending tax payments to the state, fall to the individual rather than being handled by the employer, as typically occurs for payroll employees. Contractors and employees misclassified as contractors may be failing to pay state income taxes, and businesses that pay such workers may be failing to report payments appropriately. Virginia’s Joint Legislative Audit and Review Commission (JLARC) examined this issue in 2012 and estimated $28 million in lost income tax revenue due to employee misclassification in 2010, but more updated analysis is in order.

Lawmakers should take steps to protect Virginia’s revenue base from changes in work arrangements and any negative impact of new federal tax provisions, as well as the ongoing impact of existing state and federal tax loopholes. Although policymakers cannot prevent high-income households from shifting capital gains into the future, the state could increase enforcement of labor and wage laws, particularly related to contractors and misclassified employees. In addition, as federal tax reform moves forward, the state could use this opportunity to decouple or scale back from conformity to the federal tax code and consider responses to future changes in federal law.

Moving Forward: Reversing the Trends

As Virginia moves forward, policymakers should make sure that our state revenue system keeps pace with the economy in order to generate the resources for critical investments in our long-term prosperity. That means closing ineffective loopholes and tax expenditures. It also means reforming our income and sales taxes to bring them into the 21st century by reflecting how incomes and consumption have changed over the past few decades.

This is particularly needed for Virginia’s corporate income tax and sales tax, which are not keeping pace with the state’s growing economy and public needs.

In the short-term, state lawmakers could re-enact previous reforms, such as partially decoupling from the domestic production deduction and re-adopting the “throwback rule” on corporate income. Legislation to extend the sales tax to more digital purchases would generate revenue and properly reflect changes in consumer spending. To achieve long-term adequacy, Virginia’s tax system needs broader reforms like modernizing the sales tax to apply to many more services.

As Virginia’s economy continues to evolve with new jobs and technologies, so should our tax system. If that happens, we can meet our commitments to our communities and support families and businesses across the state.