February 1, 2024

How the Governor’s Proposed Budget Would Impact Virginia Communities

Whether we have $10 or $10 million in our bank account, we all want to live in a place where we and our neighbors can thrive. Budgets show what and who we value, and Virginia’s families deserve a budget that values them by providing broad and holistic support — investing in economic support, quality public education, and more. Even with some needed investments, rather than cleaning up our tax code, addressing significant underfunding in education, and investing in affordable and comprehensive health coverage, the governor’s budget proposal falls short, with decreased state general funds for Virginia’s public education system and billions of dollars going toward tax cuts that will primarily benefit the wealthy.

TCI previously shared an analysis of key choices in the budget, which you can find here. Below is a summary of how some of these key choices will impact our communities in the areas of:

Tax and Revenue

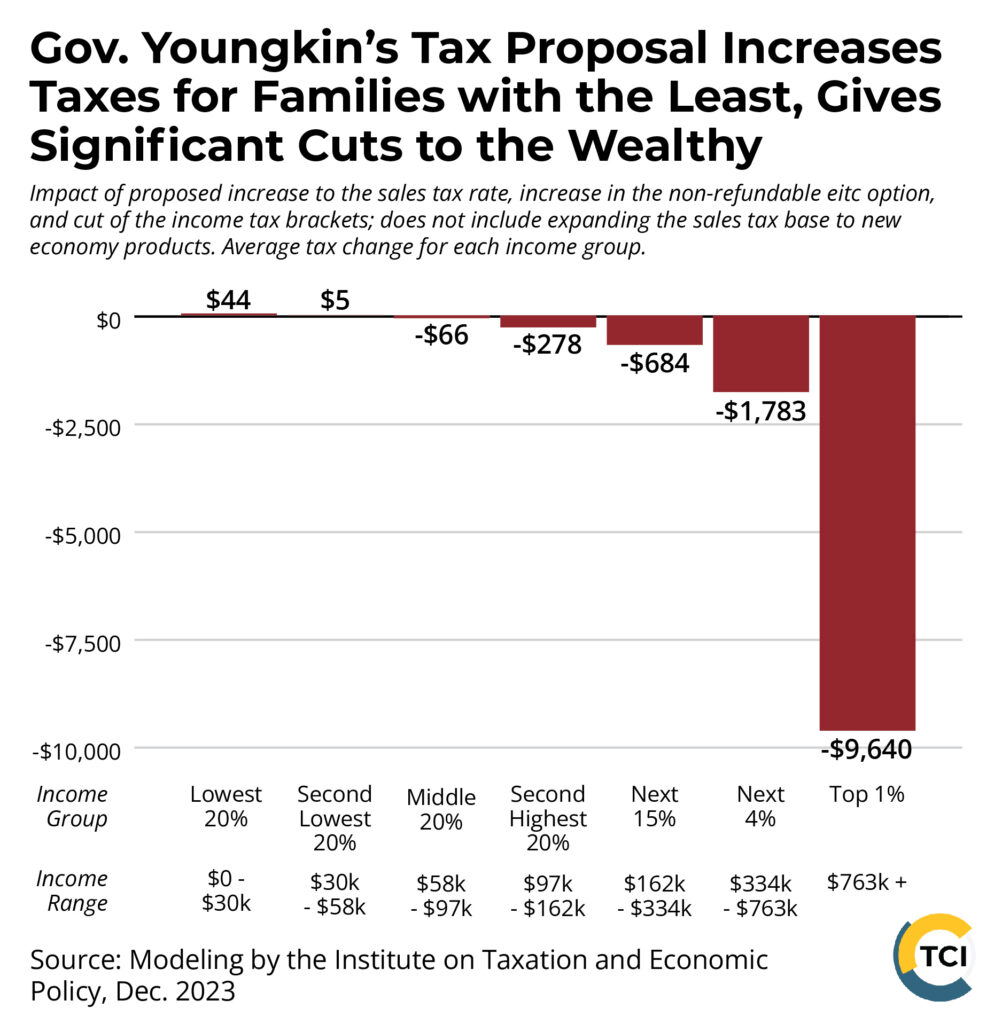

If we all pitched in our fair share, we could have the resources to make critical investments in public education, affordable housing, health care, and more. Through our tax code, lawmakers should make sure we have these resources while also lifting up families struggling to make ends meet. Virginia has an upside-down tax code, where those with the least pay more in state and local taxes as a share of income than the wealthiest in the state. Unfortunately, rather than cleaning up our tax code, the governor’s tax package will give even greater benefits to the wealthy and well-connected while asking those with the least to pay more than they do today.

The governor’s tax plan proposes the following changes that, combined, will drain nearly $1 billion from Virginia’s two-year budget:

- Reducing the individual income tax rates (costs $3.46 billion).

- Increasing the state sales tax by 0.9 percentage points (raises $1.82 billion).

- Expanding the state sales tax base to “new economy” products like digital downloads and streaming services (raises $714 million).

- Increasing the non-refundable Earned Income Tax Credit (EITC) from 20 to 25% (costs $29 million).

- Doubling the dealer discount, which is the policy that allows retailers to retain a portion of their sales tax collections (costs $35.3 million).

- Increasing the annual cap on tax credits for people who donate toward scholarships at certain private schools and non-public prekindergarten programs (EISTC) from $25 million to $30 million (costs $10 million).

Just as important is what’s missing from the governor’s budget. The governor did not include an improvement to the refundable EITC option, which provides greater access to the credit and would make sure families with the lowest incomes are provided meaningful support. Nor did the governor include a Commonwealth Kids Credit, which would help families better meet the needs of their children.

Overall, the combined impact of cutting the income tax bracket rates, increasing the sales tax rate, and increasing the state’s non-refundable EITC option will result in, on average, low-income families in the bottom 20% of incomes (less than $30,000) facing a tax increase of $44, while households in the top 1% (more than $763,000) will profit with an average cut of $9,640. While households in the bottom 20% will see an average $25 reduction from the portion of the tax proposal that adjusts individual income tax rates, very few will see any help from increasing the non-refundable EITC. This modest tax reduction will be overtaken by the increase in sales tax, resulting in, on average, a net tax increase for low-income families in the state.

And, looking forward, the introduced budget may set Virginia up for trouble in 2026. The governor’s introduced budget for the upcoming two years, FY25 and FY26, relies heavily on accumulated balances from the 2022-2024 biennium, including a transfer from the revenue reserve fund. Although this year’s revenue to date is stronger than projected in the introduced budget, using some of the accumulated balances and reserve funds for one-time purposes rather than ongoing expenses would be a more fiscally cautious approach.

For a more detailed discussion of the impacts of the governor’s proposed tax package, read “Digging Deeper: How the Governor’s Proposal Increases Taxes for Low-Income Families, Gives Significant Cuts to the Wealthy.”

K-12 Education

Every Virginia child deserves to have great public schools in their community. Unfortunately, Virginia has not been funding its share of the costs of creating those great schools: Virginia’s state research agency, JLARC, recently found that state support for K-12 education falls far short of national and regional averages, as well as what our students need according to both stakeholder analysis and benchmark studies. In total, JLARC recommends over $4 billion a year in improvements to state funding for schools. While some local cities and counties can afford to make up the difference when the state falls short, many cannot. That means that in low-income communities and those with students who face the greatest barriers, buildings are crumbling and students are not receiving the support they need to learn and thrive. Meanwhile, across the commonwealth, local schools are losing teachers and other school staff due to high levels of stress and low salaries. Further, not enough young people are willing and able to go into teaching when it means one of the deepest pay penalties in the country. Virginia teachers are paid just 68 cents for every dollar paid to their peers in other professions who have similar levels of education and experience.

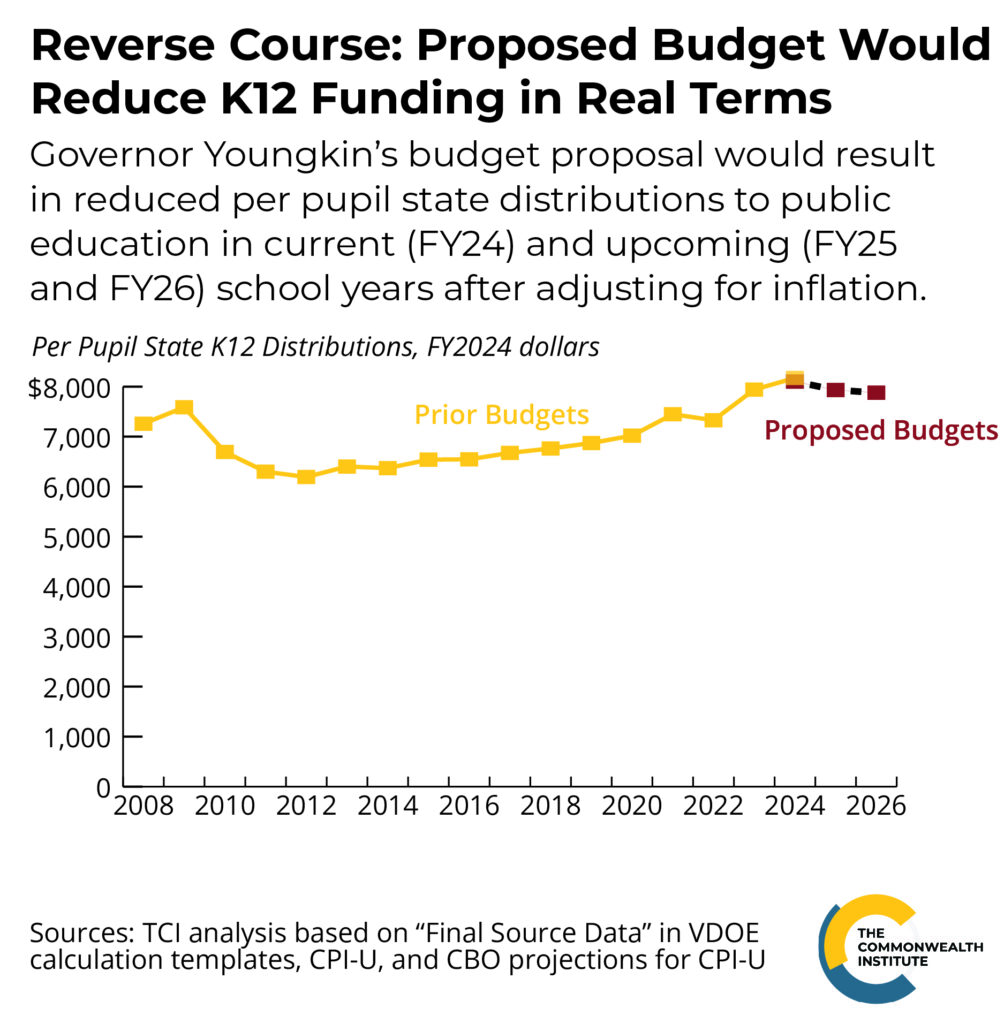

In the face of this serious need for reinvestment in our public schools, Gov. Youngkin’s budget proposal does little for students, and by many measures actually reduces state support for public education.

All told, the governor’s budget:

- Reduces inflation-adjusted per pupil distributions to public schools by 2.9% in the budget year that begins July 1, 2025 (fiscal year 2025) and 3.6% in fiscal year 2026 compared to current funding levels, using the Congressional Budget office’s projected inflation rates for fiscal years 2025 and 2026. Even ignoring inflation, which is a critical factor for maintaining adequate support, the governor’s budget proposes to reduce per-pupil funding by 0.4% in FY25 and increase it just 1.1% in FY26.

- Reduces General Fund support for Direct Aid for Public Education by $156.4 million in FY25 and $138.1 million in FY26 compared to current (FY24) funding levels. That’s a reduction of almost $300 million over the upcoming two-year budget, even before accounting for inflation. On a per-pupil basis, it’s a 0.7% reduction in FY25 and a 0.3% reduction in FY26. Add in inflation, and those reductions grow to 3.2% in FY25 and 4.9% in FY26. The General Fund is the money over which the governor and legislators have the most control and is an important indicator of how elected officials are prioritizing investments.

There are a number of reasons why General Fund support for Direct Aid for Public Education drops in the governor’s proposal, including swapping in funds from lottery revenue in the current budget year and directing money from the Literary Fund to cover other costs in the upcoming two years, which is projected to leave no Literary Fund money for school construction in FY25 or FY26.

For more details on these calculations and alternative measures and a more in-depth discussion on how and why the governor’s budget reduces General Fund support for public education, read “Showing our Work: Measures and Changes in State Support for Schools.”

Despite the overall reduced support from the state’s General Fund, the governor’s proposed budget does include some new and continued policy proposals for K-12 schools:

Given the critical findings by JLARC about the need to increase support for Virginia’s students to help every student reach their potential, any available money due to increases in special funds or changes in projections should be used to improve our public schools, not as an excuse to reduce state funding for students to pay for tax breaks for wealthy individuals.

- Mental Health:

- Flexible school-based mental health funding: The governor’s budget proposes to continue and make permanent flexible funding for school-based mental health programs, administered through the Department of Behavioral Health and Developmental Services. Funding for this program is increased to $15 million per year, up from $7.5 million in FY24. ($15 million)

- Telehealth: The governor’s budget proposes to contract with a telehealth provider for mental health services for students in grades 6 to 12. ($14 million)

- Literacy Act:

- Reading specialists: The governor’s budget proposes to increase the number of reading specialists to one per 550 students in grades 4 and 5 and one per 1,100 students in grades 6 through 8. These staffing levels were required by literacy legislation passed in 2023. ($61 million)

- Compensation: The governor’s budget proposes $53 million in one-time funding for the state’s share of bonuses for teachers and school staff in FY23 and $122 million for the state’s share of 2% raises in FY26. To receive the state funds for bonuses, local school divisions will be required to provide bonuses or equivalent actions that average 1% in FY25. To receive the state funds for salary increases, local school divisions will be required to provide raises of at least 1%. These proposed increases in funding for teacher and staff pay are lower than the projected rate of inflation and projected overall wage increases over the upcoming two years. Unless larger increases are provided, teachers and other school staff will face increasing difficulty making ends meet, and school divisions will face increasing difficulty hiring and retaining staff. ($175 million)

- Diploma Plus: The budget proposes a new initiative to grant up to $2,000 per student to support the attainment of high-demand industry-recognized credentials, using the Virginia Office of Education Economics’ biennially-updated Top Jobs List as approved by the Virginia Board of Workforce Development. Funds may be used for costs associated with VDOE-approved programs including tuition, fees, materials, transportation, or other associated costs for completing high-demand industry-recognized credential pathway training courses and credential examinations. ($40 million)

- College lab schools: Another $60 million in state funding is proposed for new schools that would be operated by colleges and universities without necessarily coordinating with local school divisions — including private colleges, according to the interpretation of the Virginia Department of Education. ($60 million)

Higher Education

As with K-12 schools, the governor’s budget amendments propose few significant, ongoing initiatives to strengthen Virginia’s system of public colleges and universities, and actually proposes to discontinue in FY26 a major initiative from 2023 to recruit and retain students who receive Pell Grants.

Pell Grants

- Governor Youngkin is proposing to remove state funding in FY26 for the recruitment and retention of students who are eligible for Pell Grants. Without these wraparound services, many students who are eligible for a Pell Grant may have difficulty navigating the complex college system. Additionally, the percentage of students who received Pell Grants was highest for Black students (72%), meaning this budget proposal will significantly impact Black Virginians.

Health Care

We all want to live in a state where affordable and comprehensive health coverage is available to everyone regardless of age, background, or medical history. With several federal COVID-era regulations protecting Medicaid health coverage and increased federal subsidies for ACA-marketplace coverage, many Virginia families enjoyed continued access to health coverage in recent years. From 2021 to 2022, Virginia’s uninsured rate dropped from 6.8% to 6.5%.

However, since April 2023, over 110,000 people have lost coverage for procedural reasons as Virginia continues its efforts to review the eligibility of everyone enrolled in Medicaid (Read more about Medicaid Redetermination). Based on other states’ experience, we expect many in this group will become uninsured. Virginia decision-makers should use this moment to invest in Medicaid and other health coverage programs to increase access to affordable and comprehensive health coverage and support robust outreach efforts.

The governor has made some needed investments in our behavioral health safety net and increased the amount of Developmental Disability waivers. However, the introduced budget does the bare minimum in funding for Medicaid/CHIP and there continue to be missed opportunities to invest in health care access and affordability, like creating a health coverage program available to all children, increasing Medicaid reimbursement rates, and expanding health services that are covered by Medicaid.

- Behavioral Health: Due to years of underinvestment, Virginia’s behavioral health safety net has struggled to meet community mental health and substance use disorder needs exacerbated by the COVID-19 pandemic. Gov. Youngkin’s proposed amendments provide funding for repairs and updates at state mental health facilities ($35 million), increased funding for crisis services ($45.6 million), increased funding for a program that helps qualified behavioral health students with loan repayment ($10 million), hospital-based psychiatric emergency programs ($10 million) and alternative transportation and custody of individuals who are involuntarily committed ($9.5 million). ($110.1 million)

- DD Waivers: Virginia has not been able to meet the demand for developmental disability waiver slots. An additional 3,440 developmental disability waiver slots were funded in Gov. Youngkin’s budget proposal. ($150.3 million)

Medicaid Texting Program: A small budget item was included to text Medicaid members to determine if they want to continue in the program before renewal. This proposal must be closely monitored as these text messages could lead to the disenrollment of eligible individuals. ($50,000)

Categories:

Budget & Revenue, Economic Opportunity, Education, Health Care