February 21, 2023

How Key Budget Choices Compare and What’s at Stake for Virginia Families

Budgets reflect our hopes and dreams for our present and future, and what’s included or excluded has real impacts on the lives of people across the commonwealth. In December, Governor Youngkin put forward a set of proposed changes to the 2022-2024 budget. On Sunday, February 5, the House and Senate had their opportunity to respond.

The House and Senate proposals represent contrasting visions for Virginia’s budget and future.

On one hand — following Gov. Youngkin’s lead — what defines the House proposals are tax cuts that cater most to corporations and high-income households. Lowering the corporate tax rate alone comes at a cost of more than $360 million in this biennium. And if this approach were to become law, corporations would pay a lower income tax rate than the top rate that many working families in Virginia pay.

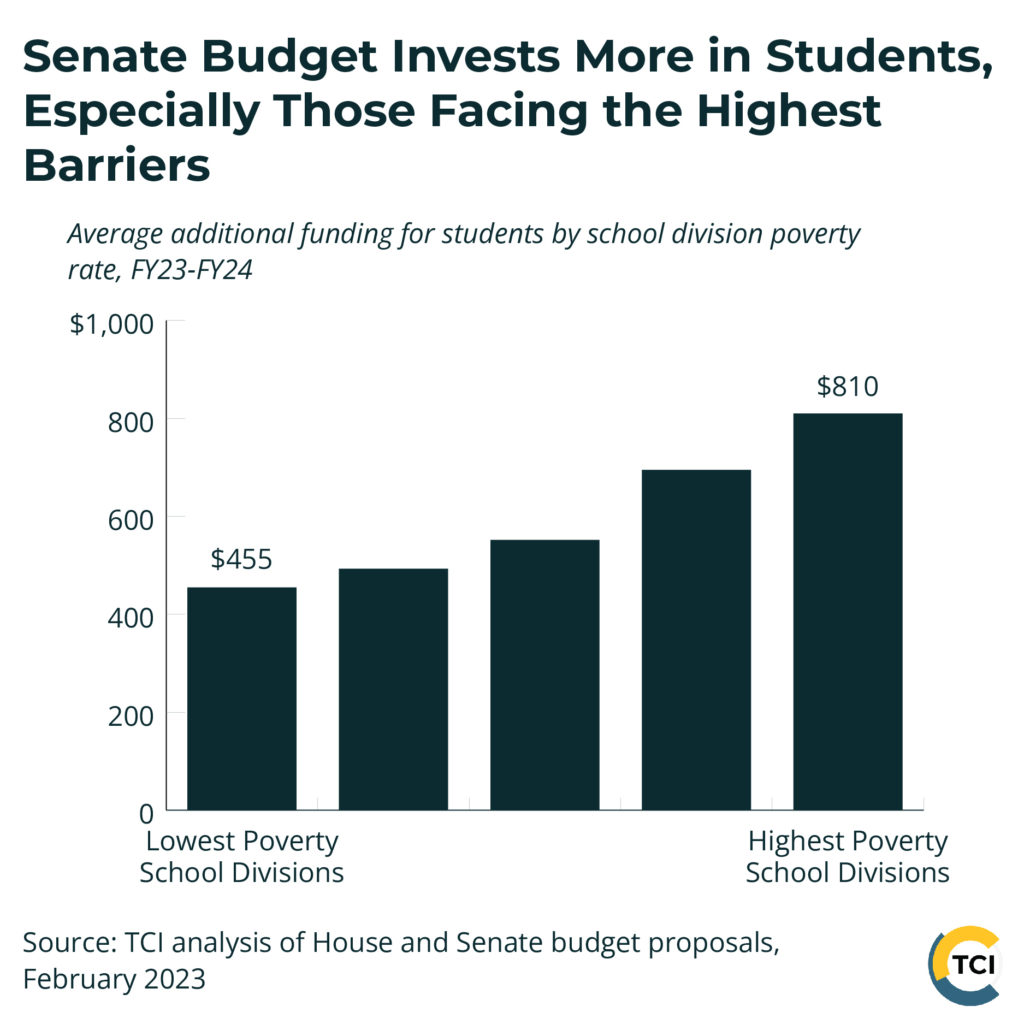

On the Senate side, what defines their proposals is the significant new funding for public education. Compared to the current budget signed in June 2022, the Senate’s budget invests $1 billion more in local public school divisions — an appropriate and necessary response to a long history of underfunding education in Virginia, a pandemic that disrupted learning and created new challenges for educators, and more recently a math error by the Department of Education that caused concern in schools across Virginia that they’d receive less funding than anticipated. If the Senate’s proposals are adopted, it will be a leap forward toward quality schools for all.

Below is a more narrative comparison of a few items that differ greatly between the budget proposals and that will have the biggest impact on our lives and those of our neighbors.

House and Senate budget negotiators will release a compromise budget deal to continue the process, which could happen as soon as Thursday, February 23. The House and Senate would vote on this “conference” budget about 48 hours later. The governor will then have the opportunity to propose amendments and line-item vetoes to the budget passed by the General Assembly. Assuming everything runs on time, the legislature will consider the governor’s changes on April 12.

Jump to:

Tax Policy

While both the House and Senate propose new, relatively small tax policy items, the key difference in the two proposals is whether they accept the governor’s proposed $1 billion in tax cuts that largely benefit profitable businesses and corporations and high-income households. The Senate resoundingly rejects the expensive tax cuts, freeing up $1 billion for investments in education.

Corporate and Business Taxes

The House accepts the centerpiece of the governor’s budget proposal, $500 million in tax cuts that will go to profitable businesses and corporations. The Senate rejects all of these proposed cuts.

- Reducing corporate income tax: A flat cut to corporate income tax would largely benefit a small subset of high-income corporations. In 2021, more than two-thirds (68%) of all corporate income tax revenue collected by Virginia was paid by a small number of large, profitable corporations that reported over $10 million in corporate income in Virginia. These large corporations are just 0.4% of all corporations that filed tax returns in Virginia, yet would get most of the benefit from a cut to the corporate tax rate.

- A large portion of the cuts the House includes in its budget will go to reducing the corporate income tax rate from 6% to 5%. This choice would cost $362 million in the current budget and balloon to $682 million in the next budget cycle.

- The Senate rejects this tax cut, freeing up $362 million in revenues to use elsewhere in their budget.

- Increasing qualified business income deduction: Initiating a qualified business income (QBI) deduction in Virginia is another substantial tax cut for profitable businesses, which will mostly benefit high-income individuals. QBIs allow business profits that are passed through to individual income tax returns to receive an additional deduction on that income — a privilege that families whose income comes from wages and salaries would not have.

- The House budget includes the governor’s proposed 10% QBI deduction ($162.1 million). This is set as half of the 20% federal QBI, the benefit of which mostly goes to higher-income households. In 2020, qualifying households with an annual income of $200,000 or more claimed 70% of the federal benefit taken in Virginia, despite only making up about a quarter of QBI claims.

- The Senate rejected this tax cut, freeing up $162.1 million in revenues to use elsewhere in their budget.

Changes to Individual Income Tax

The House moves forward with major individual income tax cuts proposed by the governor, costing $428 million this budget cycle and more in future years. The decrease in top personal income tax rate alone is set to cost $1.47 billion next biennium.

- Reducing top personal income tax rate: Virginia’s top tax bracket kicks in at income over $17,000, so the average starting teacher making just over $42,000 has the same top income tax rate as a millionaire. Lowering the top tax rate won’t fix Virginia’s upside-down tax code. Instead, it will further entrench barriers to opportunity as it would cost Virginia communities hundreds of millions of dollars that is badly needed to improve schools.

- The House accepts the governor’s proposal to decrease Virginia’s top individual income tax rate from 5.75% to 5.50% ($333.3 million). High-income earners will benefit the most from reducing the top income tax rate, making the state tax code less fair.

- The Senate rejected this tax cut, freeing up $333.3 million in revenues to use elsewhere in their budget.

- Increasing standard deduction: In the 2022 session, policymakers increased the standard deduction from $4,500 for single filers and $9,000 for joint filers to $8,000 and $16,000, respectively. While standard deductions can help reduce taxes paid by middle- and lower-income households, it leaves out many filers with low income tax liabilities. As shown by the 2022 budget, pairing a standard deduction increase with improvement to the state’s Earned Income Tax Credit could help make sure that policymakers include low-income households in the tax conversation and that economic relief is given to families who need it most.

- The House is continuing with the governor’s proposal to increase the state’s standard deduction to $9,000 for single filers and $18,000 for joint filers ($94.9 million) without additional improvement to the state Earned Income Tax Credit.

- The Senate rejected this tax cut, freeing up $94.9 million in revenues to use elsewhere in their budget. The Senate also did not include additional improvement to the state’s Earned Income Tax Credit.

There are, however, ways to make the tax code in Virginia more fair at a lower cost by adjusting tax brackets to make sure the wealthiest in the state pay their fair share and targeting support to families with low and moderate incomes through the Earned Income Tax Credit and a commonwealth kids credit.

Education

The Senate budget proposal makes major strides forward, investing in solutions to help children learn. On the other hand, the House budget has little in the way of additional investment in preK-12 education after following Gov. Youngkin’s lead and using $1 billion for tax cuts that cater most to corporations and high-income households. That’s real money that is needed for Virginia schools after too many years when the state did not fund its share of the true costs of a high-quality education, leaving behind students in communities with the least ability to pay the costs on their own without state help.

The Senate does the right thing and uses those funds for public schools, investing a billion dollars more in public schools compared to the current budget.

A full list of additional investments is available in TCI’s budget side-by-side. Below are some of the biggest differences.

- Lifting the support cap: Policymakers imposed an arbitrary cap on how many support staff the state will help fund to save money during the Great Recession, cutting hundreds of millions in state funding each year for school support staff, which includes positions like social workers, custodians, and food service staff. Since the cap was imposed in 2009, support staff decreased by 3,630 positions across the state, while enrollment increased by more than 16,000 students.

- The Senate’s budget would fully lift the cap, providing $270.6 million to pay the state’s share of about 6,500 support staff positions.

- The House budget does not include any such proposal.

- Funding specialized student support staff: The Virginia Board of Education’s (VBOE) Standards of Quality include a stand-alone staffing standard for nurses and other health staff, including behavioral health staff, at 4 staff for every 1,000 students. In 2021, the legislature partially funded this, providing the state share of 3 positions for every 1,000 students.

- The Senate’s budget fully funds VBOE’s prescribed number of specialized student support staff, providing $56.9 million to pay the state’s share of an additional 1,224 physical and mental health staff.

- The House budget does not include any such proposal.

- Increasing instructors for English language learners: VBOE’s Standards of Quality also include increasing the number of instructors for English language learners. Virginia currently provides far less support than most other states for English learners, resulting in outcomes for Virginia students lagging their peers elsewhere, and the pandemic exacerbated the barriers that English learners face.

- The Senate’s budget provides $24.3 million, which pays the state share of an additional 563 instructors for English learners. This provides 24 instructors for every 1,000 students, up from the current ratio of 20 to 1,000.

- The House budget does not include any such proposal.

- Providing additional support for students in high-poverty and challenged schools: Students whose families are struggling to make ends meet face a variety of additional challenges, including more frequent moves and high levels of stress, and these challenges compound when economic segregation creates pockets of concentrated poverty. Schools with high concentrations of poverty have difficulty attracting and retaining the best teachers and often lack the resources to make up for the state not funding schools adequately and equitably.

- The Senate’s budget provides $37.1 million in additional support for students attending high-poverty schools by increasing the at-risk add-on. The Senate also provides $38.6 million to pay the state’s share of about 1,900 temporary instructional assistants for students in challenged schools that did not meet 3 or more accreditation standards. This would fund the state’s share of 1 assistant for every 20 students in those schools.

- The House budget provides $3.0 million to pay the state’s share of 1 temporary instructional assistant for every 20 students in a small number of very challenged schools that did not meet 5 or more accreditation standards and are selected by the Virginia Office of School Quality to receive the additional support.

- Making college more affordable: Virginia has been making some progress in college affordability, yet more work needs to be done. As a result of increased state investment in financial aid and general support for undergraduate education, this year the state will cover an average of 54% of college costs for in-state students, up from 45% during the 2018-2019 school year. However, the state still covers a lower share than its target of 67% of costs for in-state students. SCHEV staff estimates that if the state met its target of 67%, tuition could be as much as $2,700 (34%) lower than current levels. High college costs are particularly challenging for students from lower-income households, including many students of color. In 2018, the average net cost of attendance at a public four-year university in Virginia accounted for 36% of median household income for Black families and 27% for Latino families, while it only accounted for about 23% of median household income for non-Hispanic white families and 17% for Asian American families.

- The Senate budget provides an additional $75 million for financial aid and almost $150 million in general support for undergraduate education to reduce reliance on tuition and fees. Together, this is a $225 million proposed increase in state support for affordable access to public colleges and universities.

- The House budget provides an additional $75 million in general support for undergraduate education at public colleges and universities to reduce reliance on tuition and fees. The House also includes language to increase grants for some students attending private colleges, but does not propose financial aid increases for students attending public colleges and universities.

Health Care

- Improving patient options by increasing reimbursement rates: Promoting a robust provider network is vital to make sure families who access health care through Medicaid or FAMIS can make timely appointments with local health care providers. Increasing reimbursement rates can incentivize more providers to accept and see Medicaid patients. Creating a broader provider network is particularly important for reducing barriers to care for Black and Latino Virginians with low incomes: although most people enrolled in Medicaid/FAMIS in Virginia identify as white, over 821,000 Black and Latino individuals participate in Virginia’s Medicaid and FAMIS programs.

- The Senate budget provides additional funding ($210m) to increase Medicaid reimbursement, including a 12% increase in personal care, respite, and companion services ($99.9m), a 5% increase in primary care physicians ($28.2m), a 5% increase in developmental disability services ($28m), and a 10% increase in behavioral health services ($17.4m).

- The House budget provides some additional funding ($53.8m) for Medicaid reimbursement increases, including Gov. Youngkin’s proposal to increase personal care, respite, and companion services by 5% ($41.6m) and other smaller increases to services and providers.

- Creating a new health coverage option for children without access: No parent should have to consider delaying medical care for a sick or injured child due to the fear of overwhelming medical debt. Currently, 13,000 children from families with low incomes are denied access to health coverage through Medicaid/CHIP and Affordable Care Act simply due to their immigration status. With little to no access to employer-based coverage, the parents of these children are left with no options for comprehensive health coverage.

- The Senate budget includes funding ($7.3m) to create a Medicaid-like program available to children of income-eligible families regardless of immigration status. This program would create a new health coverage option for 1 in 10 (10.2%) uninsured kids and mirror Virginia Medicaid/FAMIS enrollment, eligibility processes, and income eligibility levels, currently at 205% FPL ($50,963 for a family of three in 2023).

- The House budget did not include this proposal.

- Ensuring access to paid medical and family leave: Too many working families in Virginia don’t have access to paid time away from work to welcome a new child or care for themselves or a loved one when serious illness strikes. The Federal Family and Medical Leave Act (FMLA) guarantees 12 weeks of unpaid time off for some workers. In Virginia, 67% and 57% of Latino and Black workers, respectively, are either ineligible or cannot afford to take unpaid leave through the protections provided by the FMLA. For workers in low-paid jobs, missing one or two days of paid work means the difference in being able to pay for essentials like rent, food, and child care.

- The Senate budget includes a line of credit to start a universal Paid Family and Medical Leave program offering up to 12 weeks of paid leave for Virginia workers.

- The House does not include this proposal.

Compensation

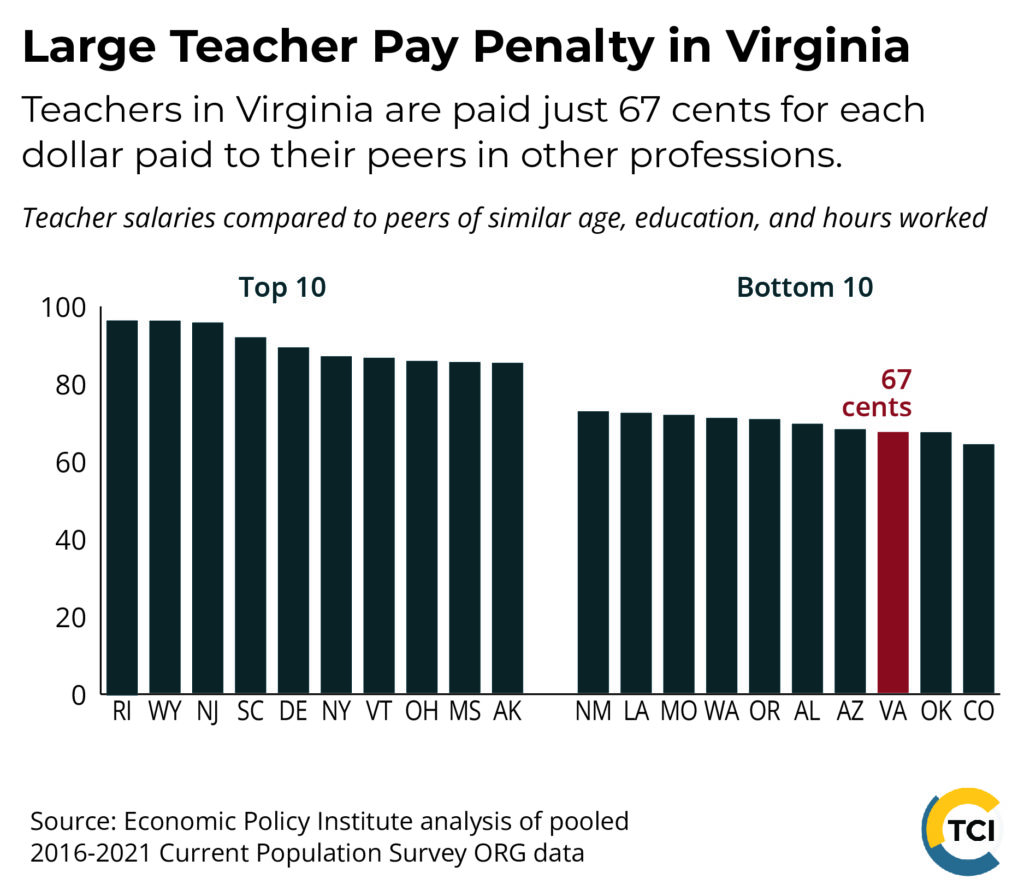

- Addressing teacher pay: Teacher pay continues to fall below the national average, and teachers in Virginia are paid just $0.67 for every dollar paid to their peers in other professions. Gov. Youngkin did not address teacher salary and sought only to provide one-time bonuses for teachers. Unlike one-time bonuses, salary increases are permanent and get Virginia closer to compensating teachers at the national average so that we do not continue to lose talented educators.

- The Senate redirects the governor’s funding to include an additional 2% salary increase, totaling 7% in the current budget. The Senate budget also budgets $140.4 million for an additional $1,000 bonus for instructional and support positions.

- The House budget proposal redirects the governor’s funding to provide an additional 2% salary increase on top of the 5% increase in the current budget.

- Increasing pay for state workers: Similar to his proposals for teachers, Gov. Youngkin relied on one-time bonuses for state workers instead of pay raises.

- The Senate budget includes a 2% salary increase for both state and state-supported local employees. The Senate also provides $66.5 million for $1,000 bonuses for all state and state-supported employees.

- The House budget includes a 2% salary increase for both state and state-supported local employees. The House also includes $21.1 million for state agencies to use at their discretion for additional targeted salary actions, such as bonuses for retention and recruitment.

TANF

- Increasing assistance for families: When families have enough income to meet their basic needs, their children have a better chance of growing up healthy and a greater opportunity to thrive. That’s why the Temporary Assistance for Needy Families (TANF) program, which helps parents with low incomes afford rent, child care, transportation, and more, is a vital tool for supporting Virginia families. With the temporary SNAP emergency allotments ending in March, state lawmakers should build on the progress made in recent years and increase cash assistance levels, which would help to correct Virginia’s long history of racial and economic injustice and provide low-income Black communities equal footing in gaining economic stability. In addition to helping families access needed resources, research shows that increased incomes result in long-term improvements for children’s health, academic, and future earning outcomes.

- The Senate proposes increasing TANF standards of assistance by 10% on July 1, 2023 (the start of fiscal year 2024) using $1.2 million from the General Fund and $9.8 million in TANF funds.

- The House budget and introduced budget do not include an increase in TANF benefit levels.

Categories:

Budget & Revenue, Economic Opportunity, Education, Health Care